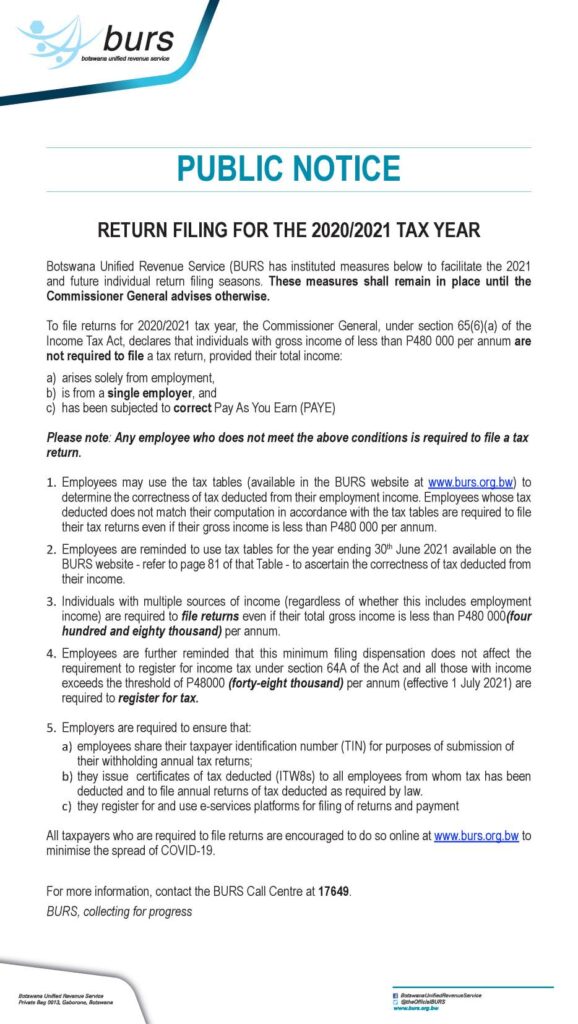

BURS public notices and guidelines

Useful links (BURS documents)

Tax amnesty scheme (applicable July – Dec 2021)

- Online tax amnesty notification form (July 2021)

- Tax Amnesty Process (July 2021)

- 2021 Income tax and value added tax amnesty guidelines (June 2021)

- Press release – Implementation of the Tax Amnesty Scheme (16 June 2021)

Get in touch with our taxation specialists for more information.

Mail us at contact@staffon.co.bw or manager.staffon@gmail.com

Frequently asked question :

BURS is Botswana Unified Revenue Service (taxpayer service)

Apply Online

– To apply for Tax Clearance Certificate (TCC) online, you have to visit the Botswana Unified Revenue Service (BURS) website to submit your application.

– Visit the BURS website and open the “eService” option under the information bar then select “e-Tax” to go to the login page.

– The following eServices are now available:

– Register online, download the application form for e-services and submit it to BURS Offices for activation.

-For assistance Contact 363 9777 or email efilingsupport@burs.org.bw.

– 24-Hours is the fastest timeframe for a Tax Clearance Pin Certificate in South Africa. You can get a SARS-issued Tax Clearance Pin Certificate within 24 hours by using our Tax Clearance Pin Certificate service.

– You can access the Burs login or BURs online e-service portal from here

– 17649

-You can access it from here